Table of Content

An appraisal is important to ensure that neither you nor your lender are paying more than the home is worth. We at Home Loan Experts successfully settle hundreds of loans with some of Australia’s largest banks and lenders every month. We can get your home loan approved faster than the standard turnaround time. By providing up-to-date mortgage documents with your application, all in one go, you can drastically reduce the time taken to reach home loan approval. Once a valuation has been undertaken and you’ve been formally approved, you can sign the contract of sale, with help from your conveyancer.

Westpac offers “Approval in Principle”, which allows you to look for properties and narrow your search based on the amount you can borrow. The process from initial application to settlement varies in its time frame. Some customers receive in-principle approval within a couple of days. Not all mortgage providers participate in the USDA loan program. And borrowers who take time to find one that specializes in USDA mortgage loans will undoubtedly find the expertise beneficial, especially during the underwriting and approval processes.

Final approval

The entire process of getting a mortgage loan comprises several processes. These include getting pre-approved and getting the home appraised before you get the loan. Because of the many steps in this process, it is impossible to put a definite time frame. In the usual market, it takes an average of 30 days to get a mortgage.

If you have any questions, this is the time to ask your lender before you go to the closing table. Once you’ve submitted your loan application, it moves into processing. In this phase, your lender will give you a list of documents that you need to provide so they can verify all of the information you provided in your application. The quicker you submit them to your loan processor, the quicker your file will move along. First, we’ll ask you about your income and assets and do a soft credit pull (don’t worry, this won’t affect your credit score). Next, our technology will instantly match you with the best mortgage options available based on your information.

The offer: 1–3 days

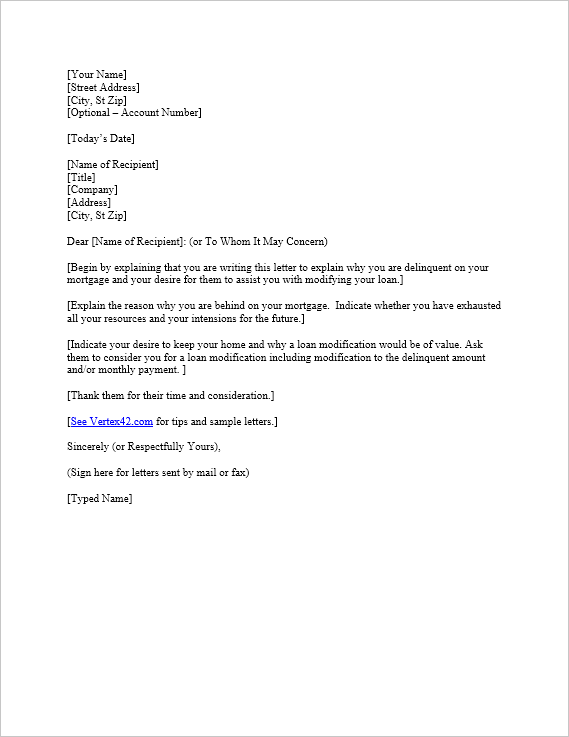

You don’t have to create new forms each time you have a new applicant. This takes the pressure of having all their information together the moment they step into your office off of your customers. It is especially helpful for first-time homebuyers who are new to the home loan application process. If you work with home loan application forms regularly, using a template is a great idea. Then if your loan application is approved we send final approval to you, and soon after that the home loan contract will be ready to sign.

Greg West was great to work with as well as his processor Terra Dwyer. They were both in constant communication with me throughout the entire process from loan application to closing. I also received very quick responses to my e-mails regardless of the time of day.

Sanctions List Search

Perhaps you want a broken window fixed or a handrail replaced—just make sure you know what repairs you’re willing to take on after the home is fully yours. As soon as you pay for your appraisal and lock in your interest rate, your lender will order an appraisal. This is to determine the fair market value of the home you’re about to purchase—in other words, how much it’s really worth. Among other things, appraisers review recent comparable sales of similar homes in your area (aka “comps”) to determine the home’s true value.

The time to start is as soon as you start thinking you might want to buy a property. Your lender will have previously provided you with a loan estimate of your closing costs. Compare this with the final costs outlined in the closing disclosures, and ask about any major differences between them.

The National Association of Realtors’ 2020 Generational Trends Report found that homebuyers typically look at around 9 listings over 10 weeks before they find the right one. If you are self-employed, please remember that IT returns is mandatory without which your home loan application may be rejected. Talk to people who have availed a home loan from the same financial institution to know how the lender functions and how you can expertise the process.

Check with your lender before agreeing to a closing date. The lender should know how long your local USDA department currently takes for final sign-off. However, in addition to property requirements, USDA home loans also have income limits. Preapproval is a more rigorous examination of your finances when your lender will establish your debt-to-income ratio and verify exactly how much you can borrow against the purchase price of a new home. Whichever way you choose, it’s a good idea to start gathering your documents. Use our checklist to make sure you’ve got everything you need.

This is not a full approval and is valid for three months. You can apply for a pre-approval even if you have not found a suitable property. The best way to start to discuss your eligibility for a home loan is to speak with a mortgage broker, as there are many benefits to using a broker. Pre-approval is also key to understanding what your home-buying budget is, adds Michelle Mumoli, CEO of the Mumoli Group at Keller Williams City Life in Jersey City.

"The initial underwriting is usually pretty quick," said Richard Airey, loan officer with First Financial Mortgage in Portland, Maine. "The good loan officers will make sure that you provide paperwork right away. That speeds up the process. What does slow things down, usually, are things like the appraisal or if problems crop up with your credit." And these last few steps -- especially the appraisal process -- can add two to three weeks to the process before you receive that final approval.

Here’s a brief overview of the information you might be asked to provide on your home loan application. BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. Advertisers and sponsors are not responsible for site content.

Otherwise, you’ll run the risk of losing it to another buyer while you wait for lender approval. Your mortgage pre-approval letter usually expires after about 60 to 90 days. This is because the factors considered before you are pre-approved can change. First you’ll select the right home loan type and term and then lock in your interest rate.

If you are interested in a CUA home loan pre-approval, check the terms and conditions and contact details. CUA’s pre-approval is given based on the information you provide about your income, outgoings and savings. CUA will estimate how much you can afford to borrow and pre-approve your home loan on that estimate. The Westpac representative will then share with you information about the types of home loans you may qualify for, along with an estimate of interest rates and applicable fees. The loan does come with income and geographic eligibility standards, though. The best way to get started is to get a USDA rate quote, which comes with a full eligibility check by a USDA lender.

Say your lender asks for two years of tax returns and you only provide one. Instead, it will ask you for that missing year of tax-return information. This all takes time, and can muck up the approval process. Connect with a local non-commissioned real estate agent to find out all the ways you can save. Communication mostly happens over the phone between buying and selling agents, so you’ll likely be waiting on your agent for the latest status updates. Once you hear back, you may have to negotiate back and forth on things like price, contingencies, and closing date until you come to an agreement with the seller.

No comments:

Post a Comment